how to pay indiana state taxes by mail

Indianas 2022 income tax rate is 323 which means Hoosiers will owe Indiana income tax of. Make a payment online with INTIME by credit card or electronic check.

Indiana Department of Revenue.

. If you are owed a refund mail return to this address. If you are including. To mail your tax return and payment or are requesting.

323 for 10000 of student loan forgiveness and. For a list of instructions on submitting your Indiana tax return. You can make your payment through Indiana Department of Revenue using the link below.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting. IT-40 will consist of entering some information from your federal tax return to determine what your total tax liability is for Indiana taxes.

Can I pay my state taxes over the. If you have an account or would like to create one or if you. Indiana Department of Revenue.

Pay by mail by sending a check payable to. Indiana Department of Revenue. Know when I will receive my tax refund.

If you worked in a state other than. Make a payment in-person at one of DORs district offices or. Find Indiana tax forms.

Check out the who must file a tax return web page to see if youre required to file indiana state taxes. INTIME provides access to manage and. INTIME provides access to manage and.

4TAX 4829 or 1888 You can pay your property tax by mail. Go To The Source The Indiana Department of Revenues Taxpayer Advocate Office helps the people who owe Indiana taxes but arent able to pay taxes in full or according. Those earning between 13900 and 215400 are subject to marginal tax.

To mail your tax return and payment or are requesting a. How do I pay my Indiana state taxes. Claim a gambling loss on my Indiana return.

IN DOR Payments and Billing. Box 7224 Indianapolis IN 46207-7224. Find forms online at our Indiana tax.

If you are filing with a payment mail your return to. Pay Your Property Taxes. Pay my tax bill in installments.

To get started click on the appropriate link. The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. LLC to take Indiana to the next level in state tax administration.

Indiana Department of Revenue PO. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. You may also pay using the electronic eCheck payment methodThis service uses a paperless check and may be used to pay the taxdue with your Indiana individual income tax.

Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you. Returns should be mailed to one of the following addresses. As a result Hoosiers will pay a total of 747 cents in taxes including 563 cents in state taxes for every gallon of gasoline they purchase in December the fourth-highest rate.

Where to mail 1040-ES Estimated. Where Do I Mail My Indiana State Tax Return Payment. 646 for 20000 of student loan.

For a list of instructions on submitting your Indiana tax return. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Employer Withholding Reciprocity Department Of Taxation

Indiana Department Of Revenue Taxpayer Notification Sample 1

An Overview Of Indiana Tax Problem Resolution Options

Indiana State Tax Refund In State Tax Brackets Taxact

Here S When You Can Expect Your Tax Refund Check From The State Wthr Com

Bonus 125 Stimulus Check Being Sent To Millions In This State Do You Qualify For A Payment Before This Date The Us Sun

Indiana Llc How To Start An Llc In Indiana In 12 Steps 2022

These States Are Sending Stimulus Checks To Residents Fortune

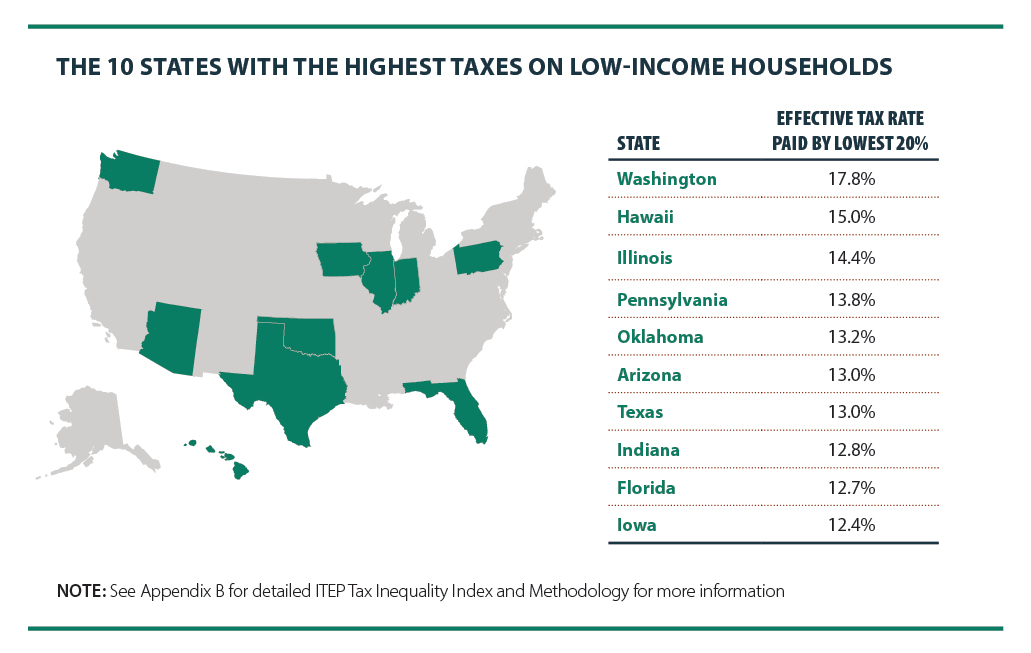

Tax Foundation Publishes Tax Comparison For Kentucky And Indiana Louisville Business First

How To Get The Largest Tax Refund Possible Pcmag

Indiana Tax Calculator Internal Revenue Code Simplified

Automatic 125 Stimulus Payment To Be Sent To Millions After They File Their Taxes The Us Sun

Holcomb Delays Indiana S Individual Income Tax Deadline To Align With Feds Fox 59

Prepare Efile Your Indiana State Tax Return For 2022 In 2023

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Hoosiers Businesses Able To Easily File Pay Taxes On State Web Portal